Prior to the dos-year launch draw, FHA (and additionally Virtual assistant and you will USDA financial support) are often the best financial choices since the that they had supply the reduced interest, payment and you will down-payment consolidation. There are traditional money solutions that enable less than 2 yrs away from a Ch 13 BK launch but they has actually large prices/percentage and require big off repayments.

Has just, the laws off Part thirteen bankruptcy inside Akron, Kansas has altered in addition to extent of one’s Chapter thirteen release is cutting-edge. We shall tell you around we could towards our very own site, however for any questions particular to the financial predicament, you could potentially give us a call. Our lawyer sophisticated during the Akron and Kansas bankruptcy proceeding law and manage be happy to answer any questions you’ve got regarding Section thirteen personal bankruptcy together with Chapter 13 discharge.

not, if there is a secured asset given that guarantee towards financing, Part thirteen will get release the responsibility with the financing but the security could be repossessed by the collector if not shell out

The fresh new Chapter thirteen launch marks the conclusion their case of bankruptcy. This is the authoritative completion of your own conformed-abreast of 3-5 year payment bundle and also the point whether your unsecured debts was discharged. They marks the start of your own (mostly) debt-free lifestyle and in case you’re https://paydayloanalabama.com/jacksonville/ upwards-to-big date together with your enough time-title obligations, just like your mortgage.

If you are wondering simply how much you are going to need to pay back throughout your customized fees package, read more on the Section thirteen personal bankruptcy. In short, your own cost bundle depends on the degree of the debt, income, and you will expenditures. Every circumstances differs and book into the financial situation. Particular debts in the a part thirteen case of bankruptcy should be paid down completely plus they are named concern expense. Top priority debts is youngster service, previous taxes, and you may alimony. not low-top priority expense on your own Section thirteen case of bankruptcy need not be paid in full, if you don’t anyway.

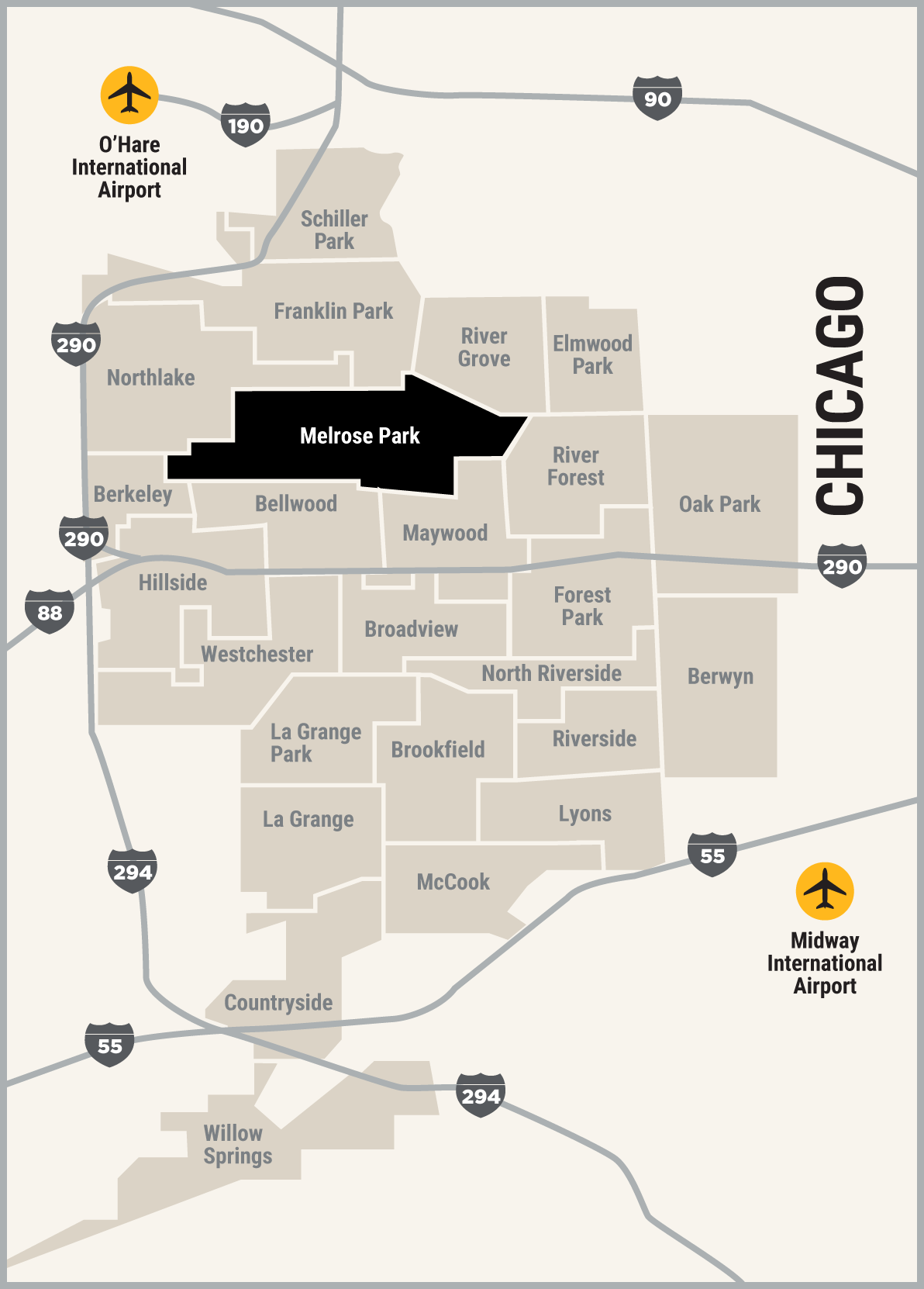

One reasoning anybody manage prefer traditional over FHA investment is if they should money a loan amount one to is higher than the fresh FHA state loan limits (that the FHA mortgage restriction try $649,750 about Altanta area urban area)

The next is short for prominent non-concern, unsecured debts which can and will also be released towards the bottom off a successful Section thirteen fees plan. Most of your launch includes non-consideration, unsecured debts.

Personal credit card debt Credit debt try a non-priority, unsecured debt therefore one a fantastic harmony left once you end up your cost package are released.

Medical Debts Medical financial obligation can be hit your all of a sudden and construct upwards right away. Medical obligations is one of the most popular explanations people have fun with bankruptcy proceeding once the a monetary financial support to find all of them from their insurmountable medical loans. You might discharge the scientific bills thanks to Section 13 bankruptcy.

Elderly Taxation Debt Very taxation and you can straight back-taxation are believed top priority expenses that simply cannot getting discharged through Part 13 case of bankruptcy. not, certain fees such as older tax financial obligation are released up on completion of the installment bundle for folks who don’t going scam and also you was basically prompt along with your filings.

Expense Associated with Breach regarding Offer otherwise Negligence Remember that Part 13 bankruptcy proceeding doesn’t discharge a financial obligation to own willful or malicious harm to a person. But not, willful or malicious injury to individual assets are discharged compliment of Part thirteen (that isn’t genuine for the Chapter 7 bankruptcy proceeding).

In your Chapter 13 case of bankruptcy, you may be in a position to slow down the principle off a guaranteed auto financing to the current value of the brand new equity secure. This action is referred to as a “cramdown.” You can be capable of geting a far greater appeal price with the vehicle.