Operating group should make money government behavior that optimize its cash-on-give information and leave their tough-attained money in their discounts levels in which they belongs. When everyday people want family repairs, deal with unanticipated expense, otherwise require a little extra currency to do something special, a house Collateral Line of credit (HELOC Mortgage) would be good option. But huge financial paigns can lead neighborhood people to blow excessively charge and you can large interest rates unnecessarily. Also the higher enterprize model variations, your own family savings tend to thanks for taking your HELOC Mortgage so you can a card union against bank.

What is actually property Collateral Credit line (HELOC)?

An effective HELOC Financing allows home owners a minimal-attract chance to power a valuable asset they already very own – equity. Immediately following years of paying off a home loan, it isn’t unusual getting operating family to require dollars to make renovations otherwise buy an essential quality of life expense.

Lenders typically allow it to be property owners to use the essential difference between the brand new left equilibrium to their mortgage while the reasonable market price away from their home because the guarantee. Supported by which safeguards, individuals discover that loan providers bring flexible cost options. The newest HELOC Loan can be means similarly to a charge card within the and therefore individuals withdraw merely what they desire. Installment plans can include detachment episodes from 10 years and fees more 2 decades. With regards to going for where to make an application for your own HELOC Mortgage, here’s 7 good reason why neighborhood borrowing relationship is greatest the brand new listing.

step 1. Borrowing Unions Are Local, Not-For-Profit Organizations

The reality that regional credit unions aren’t-for-money groups drives of numerous simple distinctions. Because the a cards union does not have investors so you’re able to dole out earnings to help you, that money are going to be enacted collectively to its professionals on the brand of down rates and fees and large dividends. Whenever people weighing the advantages of joining a cards partnership vs a lender, you to vital variation concerns a lot more offers.

2. HELOC Financing Costs are usually Down at a card Relationship compared to Financial

With respect to saving cash on the funds, the distinctions should be ample. Finance companies make a great deal of the payouts from the asking their very own people optimum rate of interest predicated on their official certification. The fresh new therapy on a card union is precisely the contrary. When you take out an effective HELOC Mortgage or any other equipment, pros in the borrowing from the bank unions performs diligently to make sure you are paired on the best solution to meet your needs. Nonetheless they deliver the reasonable rate of interest easy for its users.

step 3. HELOC Mortgage Costs are generally Straight down within a cards Connection vs Lender

Functioning families tend to join its local credit commitment as not-for-cash business structure allows administration to target giving shorter charges on the registration. While you are banking institutions can charge charge to gain more income, borrowing from the bank unions are always planning to charge a low you can easily fee to pay for provider, however to make extra money. Lower fees can be seen throughout the really account and financing. Types of smaller charges can be obtained whenever enjoying Examining and Share Membership fees, Atm fees, Overdraft fees, loan application costs, and you will closing pricing costs. With regards to a cards union compared to financial HELOC Mortgage, home owners try pleased to get the previous usually is sold with only moderate handling costs.

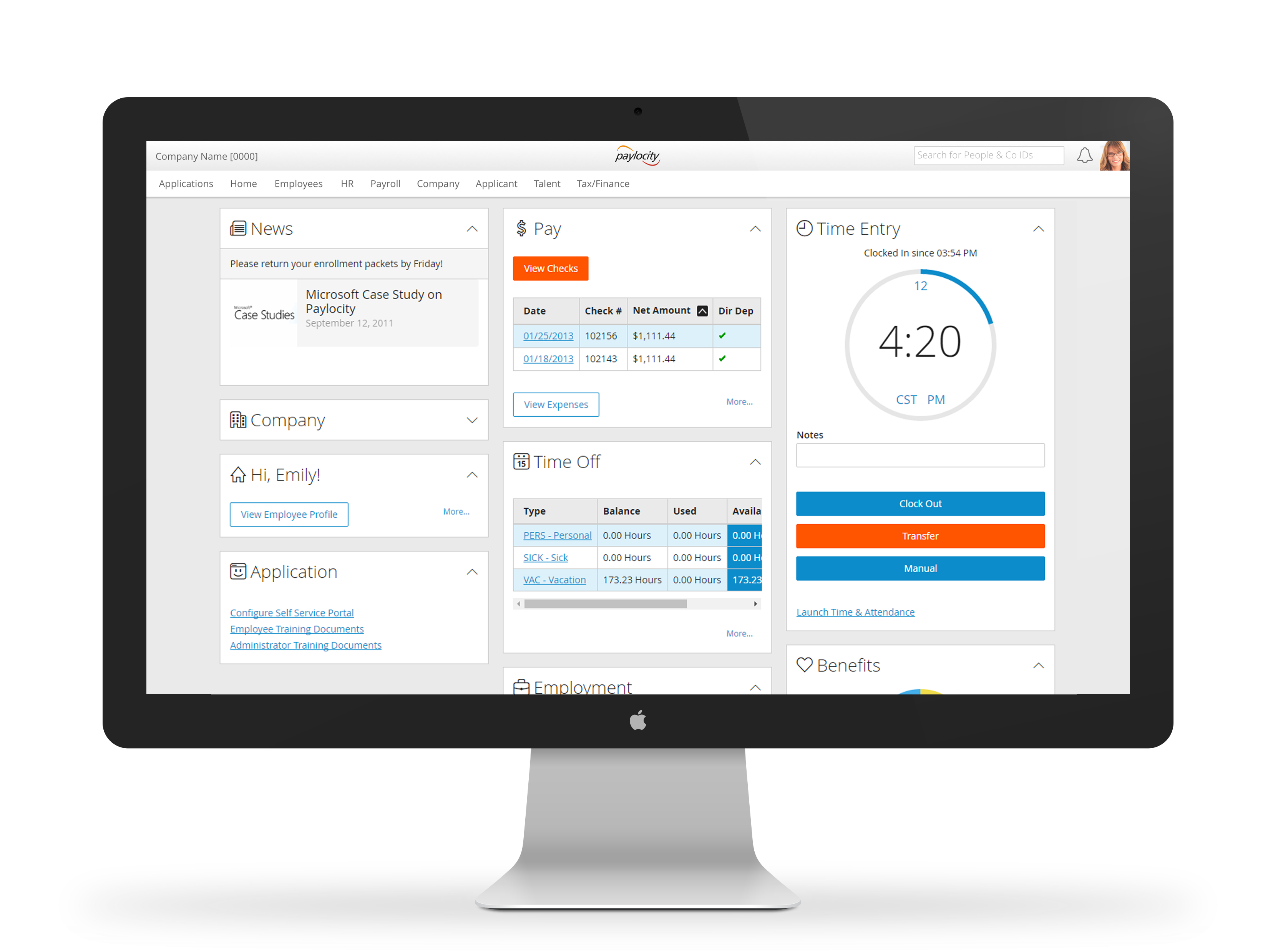

cuatro. HELOC Loan applications Come Online

Credit unions features made sure quick access in terms of using for a good HELOC by continuing to keep the method basic easier with on line HELOC software. Operating household usually discuss active dates full of each week tasks and you may appointments. The last thing individuals desires to would was schedule an after-works meeting or spend Monday day prepared in line discover out if you qualify. The capacity to complete an effective HELOC Application for the loan online and discover a remind effect of a card commitment raises the buyers feel. Credit unions themselves with the customer support. When you yourself have questions concerning the app otherwise recognition reputation, you really have an area capital you could potentially get in touch with having direct responses rather than an enthusiastic 400 number or reacting provider.

5. Borrowing Unions Promote Reduced HELOC Loan Processing & Local Choice-And come up with

When area participants need tips to pay for domestic fixes, a memorable vacation, or unexpected medical expenditures, a long time recognition process confirm frustrating. People normally choose an effective HELOC Mortgage as they understand a secure equipment generally brings all the way down interest levels and you can quicker usage of bucks.

When it comes to the financing connection versus bank timeline, the former typically outperforms aforementioned. Its goal is to try to promote lower- or no-prices money efficiently and offers a fantastic customer care. They typically keeps regional mortgage divisions that have advantages to the personnel running the fresh programs and you may approvals easily. This is exactly why credit unions normally procedure your HELOC Mortgage a lot faster.

six. HELOC Loan Concerns Was Responded from the Experts along with your Welfare planned

The professionals who do work at a card relationship contain the sense and you may options to simply help people navigate new HELOC Mortgage procedure. However they functions directly with applicants to be certain they have the finest loan unit to get to requires. It is not strange for all those in order to meet having financing professional and watch multiple selection. A card union team member’s goal is to try to let people contain the loan product that is practical for them and their novel financial situation as opposed to hitting https://paydayloanalabama.com/mount-olive/ a money mission.

seven. Making an application for an excellent HELOC Loan at the a cards Union Means You try Supporting Your regional Area

It is vital to discover vital borrowing from the bank relationship versus financial differences include more than simply lower pricing, charge, and you may approval times. After you register a card connection and take aside a good HELOC Financing, the money was reinvested in the area. The newest pool of money a credit commitment accumulates out of people facilitate carry out lower-attention solutions and often zero-cost properties.

When someone makes the error regarding investing higher prices and fees from a financial, that money is sent in order to shareholders. Put differently, you’ll be able to your finances has been exported from your own area to wealthy you to definitely-percenters. Through the use of getting good HELOC Loan with your local borrowing from the bank partnership, not only are you presently saving cash, you is actually needless to say investing in your own society.