To buy property isn’t just regarding the home enjoy. Home ownership offers income tax advantages, and matters due to the fact a major investment to have building money. Before you could enter the aggressive home-to order markets, not, it’s best to enjoys a mortgage pre-recognition at hand so you can reveal that youre a good significant client.

In this article, you will see tips description home loan repayments, what exactly is a home loan pre-recognition and how to get one.

Before you go into financial pre-approval process, you must know the new money first. To own very first-go out homebuyers particularly, mortgage repayments can seem challenging and you will perplexing.

You might have heard of the definition of PITI. payday loan Pine Hill PITI is an acronym one to stands for the latest five facets included inside the a month-to-month homeloan payment:

Prominent The original number you borrowed, before any focus. For example, if you purchase a house you to will cost you $five-hundred,100000 with a beneficial 20% down payment, you have to pay $a hundred,100000 and also you owe $400,100. The brand new $eight hundred,100 ‘s the prominent number.

Attention Basically the fee every month you have to pay towards financing, determined by the rate. Instance, for people who use $one hundred,100000 having a great cuatro% annual interest rate, you only pay $4000 with the first year inside attention. To possess fixed-rates mortgage loans, the interest rate is restricted with the longevity of the loan. There are also variable-rate mortgage loans, which means that the speed will change not as much as particular conditions.

Taxation The level of property taxes you pay relies on and that condition the property is situated in, and it also differs from year to-year. Generally, expect to pay 0.1% of home’s value monthly.

Insurance policies Very lenders require you to care for a specific number of assets insurance coverage. Home insurance covers the property out of disasters particularly fire and you can thieves.

If your advance payment are below 20%, you are tend to necessary to pay money for personal home loan insurance (PMI). This insurance coverage handles the lender in case of loan standard.

Have fun with our mortgage repayment calculator in order to arrange for their upcoming domestic get, otherwise utilize the financing evaluation calculator evaluate two additional domestic funds.

What exactly is a mortgage pre-approval?

Whenever you are prepared to do the obligation of one’s monthly mortgage repayments, you might go ahead and get pre-acknowledged getting home financing. Having a beneficial pre-acceptance at hand, you could show suppliers and you may agencies that you can so you’re able to afford the household. Actually, of several real estate agents would not actually elevates so you can family trips if you do not keeps a beneficial pre-acceptance.

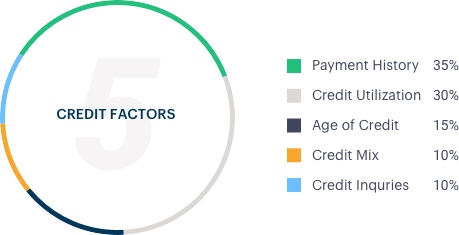

The latest pre-acknowledged mortgage count lies in your revenue, borrowing from the bank, and you may possessions. You have a steady earnings, an effective credit score, and you may sufficient property to fund the advance payment and you can closure will set you back.

Getting pre-accepted for a home loan?

- W-2 variations and you will federal tax output during the last dos decades

- Salary stubs level past a month

- dos most recent monthly statements when it comes to examining, savings, and other economic profile

- Verification off almost every other earnings or property (age.g. personal safeguards, retirement, carries, 401K, etc.)

We’re going to contact that tell you what specific files we’ll you would like away from you so you’re able to ensure your revenue and you may possessions.

How much time will it sample rating pre-recognized to have a mortgage?

Roughly per week. When we obtain the financial pre-recognition software on the web, it takes united states twenty four-48 hours to examine and ask for relevant data files away from you, that will capture anywhere from twenty-four-72 period based what data are expected and all of our skill.

The length of time do home financing pre-acceptance last?

Seattle Borrowing Union’s home loan pre-recognition letter is perfect for 120 months. Other loan providers could have various other big date limitations, such as for example 31 otherwise two months. If you fail to find the right household in the 120 weeks, we could usually collect up-to-date pointers and you may stretch brand new pre-acceptance for you.

Which have a great pre-approval could be the difference in obtaining profitable give on your future household and you will viewing additional family relations move into your dream domestic.