Even if you can afford a hefty advance payment, coupling it having settlement costs will make it difficult to become up with the income need to own a financial declaration financial. The typical debtor pays anywhere between 3 % and you will five % regarding the home loan amount in conclusion will cost you.

Utilizing the analogy more than, settlement costs toward a beneficial $450,000 financial is going to be anywhere between $13,five hundred and you may $22,five-hundred. Very, having a down payment regarding 20%, otherwise $67,five hundred, be prepared to emerge from pocket between $81,000 so you can $ninety,000.

Provided Simply by the several Loan providers

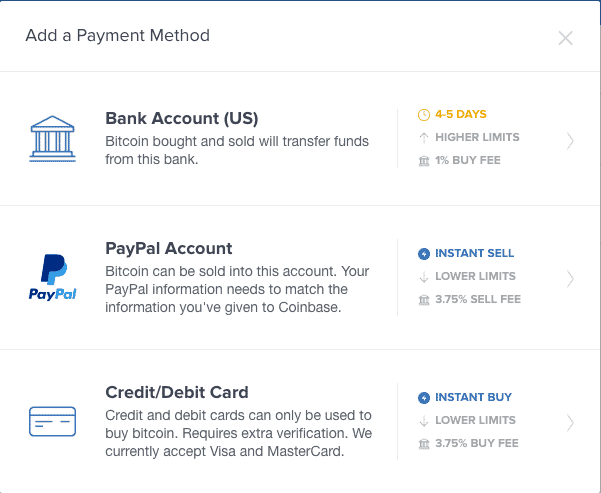

Only a few loan providers bring lender report finance. When you in conventional banks and you may credit unions, a few loan providers and online loan providers manage render they.

Just who Qualifies for Lender Report Finance?

Candidates have to have at the least 24 months out-of team experience and you can mind-employment earnings. While you are men and women details is the benchmarks, specific lenders do have more substantial conditions, while others may require most sense.

Self-working some one could have a more difficult time taking traditional money. Lender statement funds are feasible choice, but it is best that you know the way they’re going to effect your finances.

Unique Challenges and you may Pros towards Mind-Working

These types of finance be expensive and their higher rates and also require highest off repayments. Although not, you can get approved even although you features less than perfect credit or a high LTV proportion and do not must let you know some of the tax statements.

The latter advantage is essential to have thinking-functioning gurus. Of several entrepreneurs https://paydayloansalaska.net/eagle/ fool around with taxation write-offs to save cash into the fees. While this is an everyday strategy, it reduces your nonexempt earnings. Very loan providers use your nonexempt income to assess as much as possible spend the money for month-to-month loan costs, therefore, the bank statement loan are a very important resource for many who makes the greater deposit.

Providers against. Individual Financial Declaration Fund

Business and private lender declaration finance proceed with the exact same means, however, loan providers check comments regarding other profile. To possess a business bank statement loan, loan providers have a tendency to comment for the last 12-24 months of your own providers lender statements. To find accepted to own an individual financial declaration financing, the lender need browse your personal lender comments from inside the earlier in the day several-2 yrs.

Would it be Difficult to get a lender Report Mortgage?

Financial statement fund are difficult to obtain because the not all lenders promote all of them. Therefore, loan providers giving these types of mortgage loan need large off repayments and often costs large interest levels.

- Guaranteeing they are signed up to complete organization regarding state, you are looking to purchase a house

- Making certain they offer competitive words and rates compared to the most other lenders on the market

- Deciding in the event the the eligibility requirements benefit your debts

- Viewing evaluations regarding earlier and you can latest readers locate a feel for how they actually do team of course the degree of customers service try outstanding or simply average

Was a lender Declaration Loan Right for you?

A financial report mortgage is fantastic for your if you do not have a reliable earnings or never score proof of earnings from a manager. Like, the next anybody otherwise independent experts are able to use a lender statement loan:

- Self-operating someone

- Consultants

- Contract professionals

- Freelancers

- Small enterprises

Where Do you really Rating a lender Declaration Loan?

You should buy a financial statement loan out of Angel Oak Financial Choices, an on-line lender that gives a wide variety of real estate loan programs.

Besides financial declaration finance, in addition there are old-fashioned mortgages such USDA money, FHA finance, and you may experienced lenders. As well, some low-QM home loan items are and additionally available, and additionally resource qualifier fund, buyer income financing, Jumbo, foreign federal apps, and profile discover home loans.