This new qualifications standards rely on the sort of USDA home loan. The following is an introduction to a few of the well-known eligibility criteria to have both applications, however, there can be most requirements and you will restricted conditions.

USDA structure mortgage requirements

You are able to use good USDA guaranteed mortgage to pick assets and build a house, as well as standard and you will are created house, rather than to buy an existing domestic.

Standard criteria and you will qualifications are exactly the same to the USDA protected mortgage system if you buy or create property. not, you may have to work with a prescription company as well as the design will need to be examined and you can see particular assistance, such energy savings strengthening requirements.

Either, anyone score a housing financing then re-finance your debt having a home loan once their residence is prepared. The newest USDA secured loan system also offers a installment long rerm loans no credit check Delta AL combo framework-to-permanent mortgage, often referred to as one-romantic loan, that allows one to submit an application for as well as have that loan having the entire techniques. In that way you don’t need to deal with applying for a beneficial second mortgage otherwise expenses more closing costs to help you re-finance.

You will be able to make attention-just money within the framework and then the mortgage converts to your a 30-year mortgage. Otherwise, make complete money centered from the beginning. You could potentially remark the newest USDA’s directory of participating lenders regarding the construction-to-permanent mortgage system while you are interested in one among these financing.

You are able to the fresh USDA’s notice-comparison gadgets to find out if you will be eligible for an excellent USDA loan and you will if the possessions otherwise home you are looking for is in a qualified urban area:

For each research have a few different tabs that you can use to search an address discover whether it’s eligible also to influence your revenue constraints in line with the area, household proportions, and other standards.

This may already been as the a surprise, however, you can find house for the residential district areas which might be USDA qualified including extremely rural towns, states Boies. A member of family recently purchased property merely outside the urban area constraints off Baton Rouge, La, in addition to their property is in an eligible urban area.

USDA mortgage prices

USDA funds usually promote straight down rates than simply old-fashioned loans. Look lower than evaluate average costs-because tracked because of the home loan investigation and you will technology organization Maximum Blue-discover an idea precisely what the market’s for example. However, know that your own speed you will definitely nonetheless rely on your own financial and you will creditworthiness, it is therefore worthy of doing your research for the ideal home loan company to have your role.

Selection in order to a great USDA financing

Whether or not a USDA loan would be a great fit for some anybody, you do not meet up with the earnings requirements otherwise should live inside the a qualified town. Consider alternative version of mortgage loans, like:

- Conventional money: Mortgages that aren’t section of a government system. These may require 3% in order to 5% off, nevertheless have to lay at least 20% right down to end buying financial insurance coverage. You need a 620 minimum credit rating so you’re able to qualify.

- FHA fund: Government-supported finance awarded from the private loan providers and you may guaranteed because of the Federal Homes Administrations-you to definitely fundamentally wanted a credit history off five-hundred+ having a great ten% downpayment or a rating out-of 580+ having a great 3.5% lowest down payment. FHA financing has actually a mortgage premium that lasts for this new life of the loan for many who set less than 10% down. If you set 10% or even more down, you are able to still need to pay for the latest MIP, but could apply to have it got rid of just after to make into-time costs having 11 years.

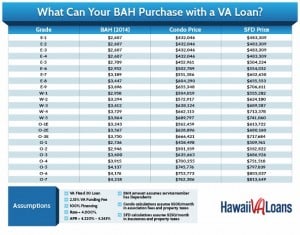

- Virtual assistant fund: When you’re a qualified You.S. military services affiliate or seasoned, a Virtual assistant financial was a good idea. Just like USDA protected financing, Va finance do not require a deposit, however may need to pay an upfront funding payment.