- ICICI Home loan Rate of interest

- Use Now

ICICI Bank Mortgage Qualification Affairs:

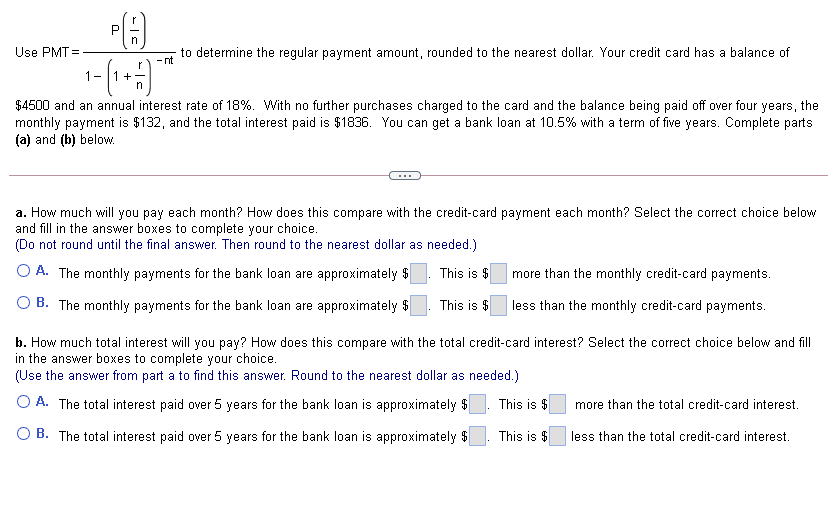

ICICI Bank offers home loan on the list of Rs. 5.00 Lakhs in order to Rs. Crores and much more at the mercy of the loan candidate/s conference all Eligibility criteria’s from ICICI Lender Financial. Home loan qualifications for the ICICI Financial hinges on the brand new below stated factors:

- Citizenship out-of mortgage applicant/s

- A position Class

- Age of candidates

- Web Month-to-month Income

- Borrowing bureau get (CIBIL Get) out-of applicants

- Value of

ICICI Home loan Qualifications According to House Position

ICICI Bank offers home loan to help you Citizen Indians doing work in certain sectors and kind out-of companies or managing & running own business. The lending company now offers mortgage to help you salaried otherwise care about-working Non-citizen Indians (NRIs) and you can People regarding Indian Origin(PIOs)operating to another country or care about-operating. ICICI Financial institutions Mortgage eligibility Requirements may vary on the basis of quarters updates from loan applicant/s.Indians paid agreeable rather than which have Good NRI Certification otherwise passport otherwise a legitimate PIO Card aren’t eligible to apply for ICICI Bank NRI Mortgage brokers. Indian people obtaining a good ICICI Bank Home loan need to have appropriate data files like Aadhaar Cards, Passport, Dish Credit an such like. To have NRI home loan individuals salaried anybody should be performing on board for over 1 decades and you may a home-operating debtor would be which have a corporate abroad for around past three years.

ICICI Houses Loan Predicated on Brand of A career

ICICI Casing Mortgage qualifications from loan candidates may vary to your basis from a job brand of borrowers, eligible kind of employments getting resident Indians comes with Salaried People, self-employed somebody and you may doing advantages for example Cas, Architects, CS, Doctors although some that have an expert training.To have NRIs salaried anybody and you will notice-employed business owners can use to possess ICICI Mortgage. This new eligibility calculator and you will standards may differ for Salaried and self-working resident Indians and salaried and you can self-operating NRIs.

ICICI Houses Loan Qualification Considering Money regarding Candidate/s

Net Monthly income out-of a mortgage borrower was an incredibly vital mortgage eligibility factor to accept and approve a loan app, while the ICICI bank assesses that loan applicant’s installment capacity for this new needed amount borrowed according to online monthly paycheck or earnings off applicant/s. Web monthly money to possess an effective salaried personal was calculated into online salary number credited monthly in the/their own income account, basically websites monthly income equals in order to disgusting income minus PF, ESCI, PT, TDS while others as the appropriate. The minimum internet income required to sign up for ICICI Financial Household Financing is actually Rs. 25000/-. Internet monthly eligible income getting operator is equal to yearly Internet earnings along with depreciation, focus paid down into fund, other earnings (if any as per California formal Balance sheet) minus taxes divided by 12 (months). Depending on ICICI Lender Mortgage plan, it takes 60-70% of your own net month-to-month money mainly based up on their http://www.paydayloanalabama.com/bon-air character so you can calculate your house financing eligibility count. To phrase it differently, the lender will offer a mortgage EMI around 60-70 % of your own net monthly earnings. If a debtor is having every other repeating personal debt the bank wil dramatically reduce the brand new EMI/s of these monthly installments (only if more six EMIs is actually owed) on the 60-70% matter before measuring the past loan qualifications matter.

- Gulf coast of florida Cooperation Council (GCC), political and you may financial alliance of six Middle east-Saudi Arabia, Kuwait, the newest United Arab Emirates, Qatar, Bahrain, and you can Oman.

- Matter stated or equivalent

ICICI Financial Qualifications Predicated on Many years

Age of financial candidates the most important home loan eligibility standards in ICICI Financial, the minimum chronilogical age of the fresh candidate is no less than 21 age during applying for mortgage (in the event the earnings felt, when the income of your co-applicant is not considered to calculate the borrowed funds qualification number, in this case minimal age shall be 18 age). Restrict years getting a beneficial salaried debtor should not exceed sixty age and also for care about-employed 65 age until the readiness of your own financing period. Having NRI people minimum ages required try twenty five years and restrict was sixty decades.

Loan amount Qualifications and you can Qualified Loan Tenure

Chronilogical age of the borrowed funds candidate is really crucial for ICICI Family Loan to determine maximum loan period they could bring in order to that loan candidate. Years has an effect on this new qualified amount borrowed away from a borrower as well- higher the brand new tenure of the mortgage, all the way down may be the Mortgage EMI as a result large will be the home loan count qualifications. If the ages of a home loan debtor was highest, ICICI Financial gives less tenure towards debtor given that where EMI will be high and that will clean out home financing qualification of the borrower.