Are you currently a first house buyer? Work-out brand new deposit you may need initial to meet up the purchase speed, almost every other can cost you you should keep in mind when buying a great domestic, and how to enter your property sooner.

Guide a scheduled appointment

A faithful bank will get back into touch with you in this step one business day. They answer your questions about lenders and guide you as a result of next strategies. Your bank can initiate the application to you personally.

Once you have located a property that fits your financial budget, it is the right time to work-out just what deposit you could put down. A much bigger deposit function you will have to acquire less, for example you can easily pay shorter interest and possibly straight down month-to-month money.

Always, 20% of the full value of the home is a good count to attempt to have while the in initial deposit. You can nevertheless score that loan for those who have an inferior deposit, however might need to take-out Loan providers Mortgage Insurance coverage (LMI) and this adds an additional cost towards the financing. It will probably and additionally take longer to settle.

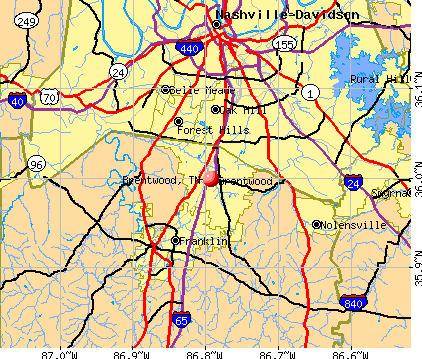

Extremely lenders use financing so you can worthy bad credit installment loans Tennessee of (LVR) calculation to evaluate the amount he is ready to lend to possess a mortgage. LVR is the level of the loan compared to the Bank’s valuation of your property, shown because a share.

Such as for example, that loan out of $400,000 to invest in property worth $five hundred,000 leads to financing to really worth ratio out-of 80%. Finance companies lay a limit towards loan to help you well worth proportion oriented into the things such as the type of possessions, the location and your financial position.

If you know the quantity you will want to choose the home, together with size of deposit you need, have fun with our home Saver Calculator so you’re able to with ease work-out how much time it may take to save the latest put for the brand new home.

Most other initial will set you back to adopt

There is certainly far more to purchasing property than simply the cost of our home in itself. There are some other upfront will cost you you’ll want to learn about.

Stamp duty

Stamp Obligations was your state and you will region authorities income tax that will change according to things such as place, whether it’s a primary home otherwise an investment, therefore the price of the house. It is important you take so it into account when searching to find property our very own Stamp Duty calculator might help give you an idea of exactly how much then it.

Judge costs

Several judge strategies are involved when buying possessions. Conveyancing (the newest sale and transfer regarding home) range from property and you can term lookup, new comment and you can replace of one’s package off sales, brand new import of one’s identity, and other facets as well.

Home loan facilities and you can membership charge

These could trust the official the place you alive and you can which the lender is actually. Understanding if these apply at your is even extremely important. Find out more about the brand new initial will cost you of shopping for a property

Affairs that affect your loan and you can interest

Now you learn their budget, simply how much you would like to suit your put, while the almost every other potential initial will cost you. Including these types of, you can find additional factors you to definitely ount a loan provider was happy to financing you and the rate they may charge.

Your credit history and you may get facilitate loan providers assess what you can do in order to pay off and you may carry out borrowing, that impact the size of the borrowed funds and the focus rate. A high credit history can see larger fund from the down prices, when you’re a lower life expectancy rating you’ll comprehend the contrary.

With a savings plan to let accumulate their put is actually an excellent good way to guide you can meet mortgage repayments in addition to, make sure that you will be making regular costs towards the playing cards or any other borrowing from the bank items you have got, to aid enhance your credit score.

Service for first-time people

Government entities has a one-away from fee which are often made to first-go out home buyers, helping all of them to your the very first domestic. The total amount, standards and you may information having a first Property owner Give start around claims and you may areas, very consult your financial or have a look at the new Government Government’s Basic Homeowner Offer webpages to learn more.

Having a cost savings want to let gather your put was a great fantastic way to show you will meet home loan repayments along with, make certain you are making regular repayments with the handmade cards or any other borrowing situations you may have, to help improve credit history.

Very loan providers want in initial deposit with a minimum of 20%, and come up with protecting to own a deposit a bona-fide barrier so you’re able to owning a home. Towards the Australian Regulators initiated Household Guarantee Program, first-day home buyers you’ll punctual-tune owning a home goals which have certainly one of three verify selection 1 .

Once you understand the restriction borrowing from the bank stamina

Their credit strength relies on your personal problem, life, money, costs, credit score, and other affairs. Should you want to estimate the credit electricity easily and quickly, try using our borrowing from the bank energy calculator.