The capability to direct a customer in order to a particular supplier. Referral energy is dependant on guidance and you will power of the referrer, and you can ignorance of your visitors.

A mortgage webpages one to raises potential consumers in order to participating lenders, in many cases so you’re able to numerous a huge selection of all of them. The main entice with the consumer was information about simple pricing released by the loan providers.

The financial institution whom retains the following home loan becomes repaid merely immediately after the financial institution holding the initial home loan are paid back

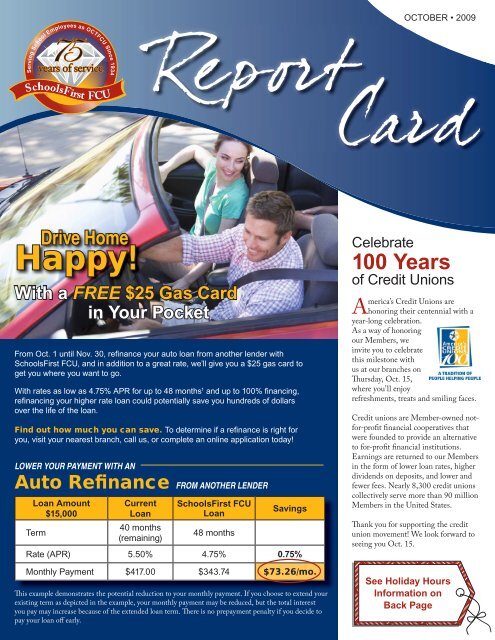

It completed to eliminate borrowing from the bank will set you back under requirements where this new borrower can buy a different sort of loan within an interest rate below the price to your established mortgage. It can be done to improve cash, as an alternative to property security mortgage. Or it could be done to slow down the payment per month.

An enthusiastic increment over the rent reduced into the a lease-to-own house purchase, which is paid for the price if your buy choice is actually exercised, however, that’s destroyed should your option is not worked out.

The entire cash required of the home customer to close the exchange, also downpayment, situations and you can fixed buck fees paid off into the financial, one portion of the home loan insurance premium that’s paid-up-front side, or other payment charges of the transaction like name insurance policies, taxes, etc.

The actual Estate Settlement Procedures Work, a national user safety statute very first introduced during the 1974. RESPA was designed to manage domestic people and you will residents selecting payment features from the mandating specific disclosures, and you will prohibiting referral charges and you will kickbacks.

A loan provider which offers mortgage loans to anyone. Since the distinctive from a wholesale financial just who works using mortgage brokers and correspondents.

That loan to help you an elder resident about what the balance rises throughout the years, and that isn’t paid down till the owner passes away, offers our house, otherwise motions out forever.

Ideal from refinancing individuals, according to the Basic facts during the Financing Operate, to help you terminate the offer for free so you can themselves contained in this 3 times of closure.

Choosing the interest and you can commission into the a supply will change in reaction to specified coming changes in market rates, titled scenarios.

The amount the fresh new debtor try required to invest for each months, along with interest, dominating, and home loan insurance rates, underneath the regards to the loan offer. Investing below the fresh booked count causes delinquency. On most mortgage loans, the fresh scheduled percentage is the totally amortizing commission in the life of one’s mortgage. On the specific mortgages, yet not, the latest arranged percentage to the first 5 otherwise 10 years is actually the attention fee (get a hold of Appeal Merely Mortgages). As well as on alternative (flexible fee) Hands, it can be brand new minimum commission because discussed because of the system (get a hold of Alternative (Versatile Payment) ARMs).

The complete necessary money is found into the Good-faith Guess out-of Settlement loans in Elberta that each borrower receives

A borrower whom need certainly to file money playing with tax returns as opposed to pointers provided by an employer. That it complicates the procedure slightly.

A contribution so you can an effective borrower’s down-payment or closing costs generated by the a property vendor, as an alternative to a price reduction.

Supply from a mortgage from the vendor of a property, will a second mortgage, given that a condition of one’s income.

Administering money between the time of disbursement and also the day the newest financing is actually fully repaid. This consists of collecting monthly obligations regarding the debtor, maintaining records regarding mortgage improvements, to ensure repayments away from taxation and insurance coverage, and you may looking for unpaid accounts.

An installment produced by the fresh new consumer from a mortgage on provider towards the release of this new servicing on the home loan. It offers no lead relevance so you can borrowers.