Next Home loan Interest rates and you can Fees

Contemplating bringing a second financial? It is a handy answer to make use of your house’s well worth for larger systems or even to pay off bills. However,, just like with your first mortgage, you’ll find interest levels and you may charges to think about. These could are very different a lot, thus knowing the basics could save you currency and you may fret.

Rates to possess second mortgage loans would-be more than your first financial, since they are recognized as a little while riskier to possess lenders. But do not proper care, on right pointers and you can possibilities, you will find a great deal which works for you.

Prepared to plunge deeper making informed alternatives? Sprint Resource will be here to guide you from the fundamentals regarding second mortgage loans.

What does the second Home loan Imply?

A moment home loan, often referred to as a house security loan, feels like a loan you earn making use of your household while the collateral.

- It comes down next lined up having payment. This means if you fail to make costs, the financial institution usually takes your house to settle your typical mortgagefirst, and, then people leftover money is certainly going into second financial.

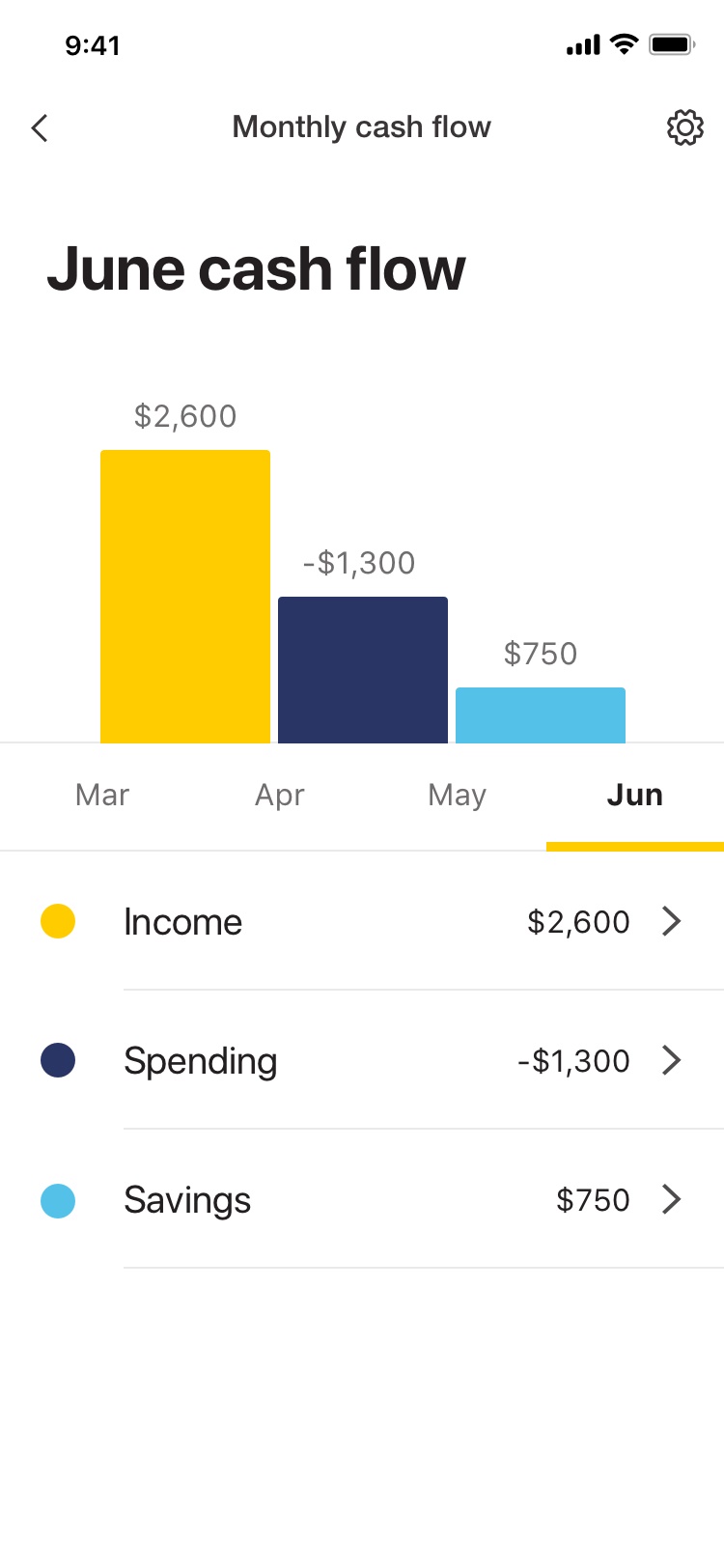

- You have made the money based on how far security you have got in the home. Security is largely the difference between exactly what your residence is well worth and exactly how far you still are obligated to pay on your typical mortgage.

Some body take out 2nd mortgages for some causes, eg upgrading their property, settling personal debt, otherwise covering huge expenses.

Remember, rates of interest to your second mortgages changes with regards to the market, precisely what the bank requires, and your own finances.

Benefits of one minute Financial

- Income tax Gurus The interest this one pays with the a home equity financing could probably become income tax-allowable. Its, but not, vital that you speak to your income tax mentor to ensure new taxation deductibility of great interest.

- Unification off Money If you’re already juggling several monthly payments, combining these with the a single, manageable house security mortgage payment you may clear up your financial life.

- Aggressive Interest rates Family security loans are notable for its tempting rates of interest. When always consolidate higher-focus handmade cards, new savings are unbelievable.

- Accelerated Loans Freedom Whether your holy grail is going to be entirely financial obligation-100 % free, restructuring your current expenses with a house security financing could well be the ideal strategybining which which have abuse and you may dedication, you may find your way so you’re able to debt removing easier and you can faster than just your envision you are able to.

Exploring the Varieties of Second Mortgages

In terms of ways to use the fresh collateral of your house, understand that the term next financial describes different funds. Is a close look from the different kinds of next mortgage loans available, each with exclusive keeps and you may advantages.

Domestic Collateral Money (HEL)

A property Collateral Loan has the benefit of a predetermined sum of money that is safeguarded by the security of your property. Its generally speaking paid inside a lump sum, and you also pay the loan from the a predetermined interest rate more than a predetermined several months.

That it balances are ideal for cost management aim, but it also mode you’ll begin paying interest on the complete loan amount instantaneously.

Domestic Equity Personal line of credit (HELOC)

A house Security Personal line of credit features more like a cards card. It gives a max credit limit, and you can use as required in draw period. During this period, you could only have to afford the attention on the number taken. After the draw period https://paydayloanalabama.com/tidmore-bend/ ends, your enter the installment several months, in which you repay the primary as well as appeal. HELOCs normally have varying rates of interest, which means your costs may differ as the rates change.