One step-by-Step Help guide to Auto Funding

That this new car smelling. A spotless interior. The updated technology. This new versatility of getting your transportation. Provided a few of the issues that incorporate the latest auto possession, it’s easy to see why many draw to invest in the first auto because a captivating milestone. To possess a first-go out client but not, figuring out vehicle capital may become daunting.

Before you fill in a cards software otherwise visit the brand new dealership, use this guide to with confidence move forward in the process.

To acquire a unique automobile shall be a massive investment decision. Thus devote some time to learn a number of need-to-knows before heading into the dealer.

Research their drive

Deciding on the vehicles that meets your own personality and your life try extremely important, and you may desire sensible of what you are searching for before a car dealership go to. This will help your remain concerned about what you are most just after and you will avoid response to find.

With the amount of possibilities, what sort of vehicle do you find your self riding? Are there particular cover otherwise entertainment has you want to keeps? Should you decide rent otherwise pick? Is an electronic vehicles (EV) a factor for your requirements?

americash loans Moundville, AL

To assist guide your research, consider your appeal, driving point, offered asking programs (if you’re considering a keen EV), how many people your typically have as well as environment conditions.

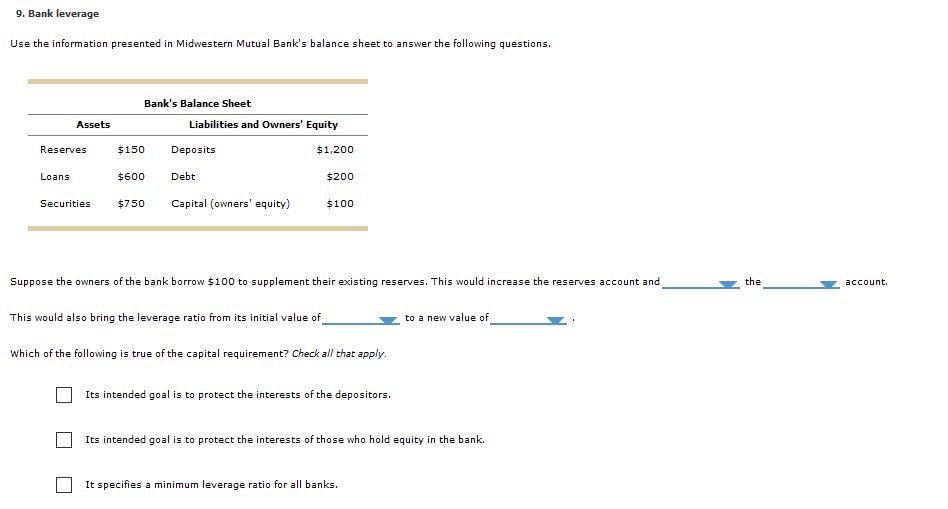

Understand how borrowing functions

Your credit score is utilized because the a way of measuring your creditworthiness. This is one way almost certainly youre while making money from inside the good timely and you can consistent amount.

Fico scores was tracked of the three major credit agencies: Equifax, TransUnion and you may Experian. Boat loan companies look at the credit history from a single or maybe more firms, event facts about the borrowing from the bank and you will percentage activities. Your credit history are built-up, each borrowing from the bank bureau creates a score that assists financial institutions determine your own credit exposure; credit scores start around 350 to 850.

Typically, the better your credit rating, the greater funding choices you are going to located. Even though there might possibly be days where you aren’t limited borrowing from the bank history (eg an initial-date client) possess a high credit score, financial institutions usually look at earliest-go out auto customers because risky getting investment.

Due to this, take time to understand more about any first-go out consumer software supplied by finance companies and automakers. You may also possibly see somebody who is ready to end up being a beneficial co-signer or co-client on your own investment package.

Cut to have a downpayment

A down payment are currency you only pay into the cost of the automobile. They decreases the number your debt and sometimes functions as a beneficial good faith motion to demonstrate financial institutions youre a significant customer. Additionally affects their rate of interest, payment per month and will be needed to suit your borrowing from the bank acceptance given that a first-big date client. The larger their down payment, the newest shorter you are money. It means you only pay shorter notice over the course of the bargain.

There was a broad rule of thumb one to an advance payment are going to be at the least 20% of the vehicle’s cost. But it isn’t really necessary for your finance company or supplier. Certain boat finance companies ount.

Buying a motor vehicle is sold with apparent expenditures like the payment, strength, routine fix and maybe even a keen EV billing station to suit your domestic. However, there are other can cost you in order to getting an automible so you’re able to grounds inside in terms of simply how much auto you can afford. Such mutual costs are with each other called the rates out-of control.

Total cost out of ownership is sold with registration fees, fees, and you may insurance. In the event the vehicles needs expertise things such as snow tires, you will want to determine one-offs like those too, because they get perception your annual expenses. It is possible to want to consider any annual or monthly subscriptions, like vehicles emergency attributes or explaining properties.