Qualified Representations and you can Warranties The seller is eligible to have respite from administration of your own following the representations and you can warranties about the latest borrower’s assets: ? The sufficiency of one’s borrower’s assets to purchase “Overall Loans getting Verified” matter shown towards Past Viewpoints Certification; and you can ? The accuracy and you can stability of the investigation illustrated to your asset verification statement.

Documentation Criteria Brand new resource verification declaration is acceptable records for confirmation of the “Total Finance to get Verified” amount indicated towards Last Feedback Certification. The fresh new investment verification statement should be handled regarding home loan document. Note: You need to make sure and document, as required by Publication to your advantage type, extra loans required for particular Financial purchases which aren’t provided throughout the “Overall Money to get Affirmed” number conveyed towards Last Viewpoints Certificate*. The newest documentation must be handled regarding Financial file. installment loans Fresno OH (*Refer to Wisdom Mortgage Product Advisor’s Commitment of cash-to-Intimate work aid having samples of if this commonly implement).

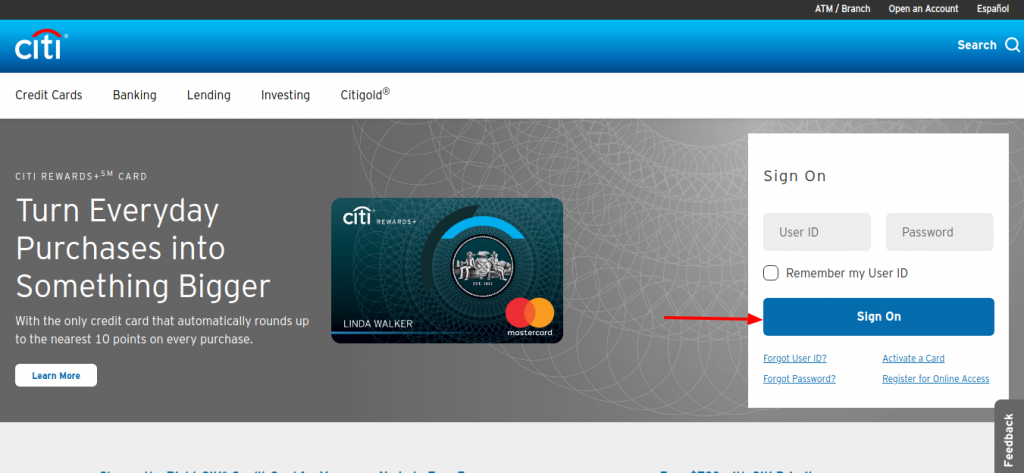

Once you are linked to the service provider, Freddie Mac need to be subscribed to get resource confirmation data out of that provider on your relevant fund

Not Qualified Representations and you will Warranties The vendor isnt eligible for rest from administration of representations and warranties associated with the new borrower’s asselizabethts* (elizabeth.grams., not enough confirmed assets to cover the Overall Financing becoming Affirmed otherwise an enthusiastic Ineligible Home loan).

Papers Standards ? In the event that a secured item confirmation statement try obtained, this new resource confirmation declaration is acceptable papers into the matter affirmed and must end up being was able regarding the home loan file. ? Having finance you to definitely receive a secured asset agent and you can warranty save result off Not Eligible towards history Viewpoints Certificate due to not enough funds verified the extra financing you’ll need for the mortgage purchase must be noted due to the fact called for for each the new Publication for the house types of. The latest papers have to be maintained on mortgage document.

Owner is not eligible for relief from administration away from selling representatives and you can guarantees linked to brand new borrower’s property. This might be due to destroyed otherwise partial information throughout the provider otherwise a network are off.

*But not, the loan can still be eligible for recovery provided courtesy Freddie Mac’s offering logo and you will assurance build since described for the Publication Area .

Immediately following options is finished, you can start capitalizing on Aim along with your finance

Notwithstanding the requirements of Book Sections 3402.5 and you may 3402.8, for mortgages picked having pre-closing and you will/otherwise blog post-closure quality assurance review you to discovered a valuable asset agent and guarantee recovery result of Eligible into the history Viewpoints Certification, you are not required to: ? Reverify otherwise recalculate eligible advantage designs that will be shown on advantage verification statement.

The second several sub-areas security facts to make use of Aim for Possessions, like the first configurations procedure and you may steps for making use of Aim having Financing Product Advisor.

Initial Settings To profit from Point given due to Mortgage Tool Advisor, you need to earliest end up being create which have a minumum of one service provider (FormFree, Finicity, Mix and you will/otherwise PointServ) to find a secured asset verification report using solution provider’s program. Refer to the appendices getting service provider-specific suggestions.

Procedures to possess Originating Finance With the Automatic Advantage Evaluation So you can originate fund which might be entitled to asset rep and you will warranty rescue, you must finish the steps outlined below. Considering the business’s business process, the order the place you finish the methods ples certain so you can the service providers are offered about appendices.

Step one: Submit Financing to Loan Product Advisor to assess the complete Loans to-be Affirmed To simply help dictate the degree of possessions requiring confirmation, fill in the mortgage so you’re able to LPA to own review and remark the complete Funds become Verified number placed in the brand new Resource Facts point of your Views Certification.