You really have heard a bit straight back that the bank card issuer try entering the borrowed funds games, and from now on their surgery are officially live.

In the event the were wanting to know, it scratched and you can clawed its method towards financial biz by obtaining loan origination possessions out-of Forest, earlier labeled as Lending Forest.

Precisely what does Come across Lenders Offer?

As well as are used for possibly a purchase or a beneficial refinance, plus one another rate and you will name and cash-away refinances.

From the fixed-rate agencies, you could potentially make an application for anything from an effective ten-season repaired in order to a thirty-season fixed, with fifteen- and you will 20-season repaired solutions in-between.

Getting Palms, the choices try limited by terms of about three, five, and you will eight many years. The most popular ten-12 months Arm are significantly absent.

For FHA finance, they provide a fifteen-season and 29-seasons financial label, and you can a changeable-rate choice. Therefore little also pioneering here, only basic home loan products.

Why are Discover Book?

Really, they claim for a streamlined software techniques, definition it needs to be an easy task to incorporate and get acknowledged getting the financial.

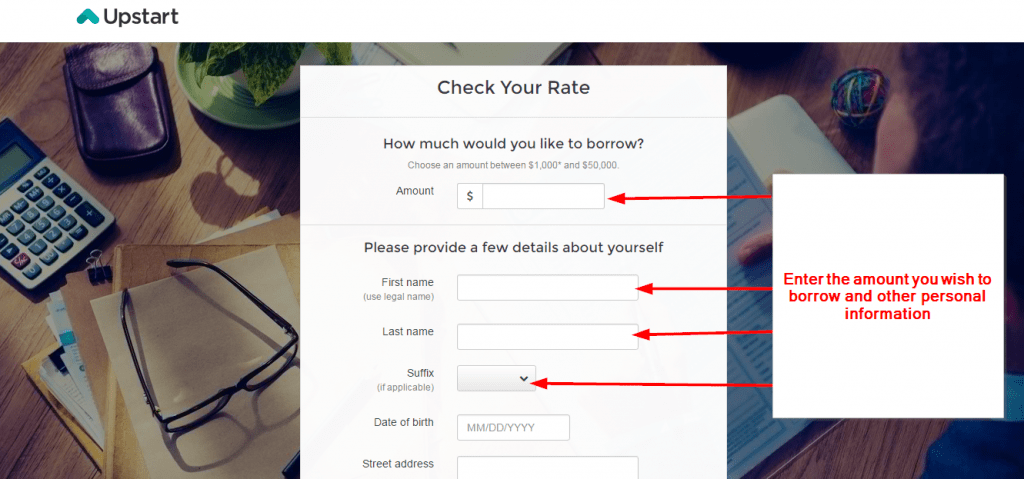

You can start the process on line because of the setting up some basic information, right after which a find financial banker will call your right back. One exact same mortgage banker was along with you out of start to end up.

On the other hand, it allow you to properly publish data and look the fresh new condition of mortgage 24/eight, through their home financing credit website.

For date, they supply an effective Romantic punctually guarantee you to definitely guarantees they will ensure you get your loan financed once the planned otherwise provide average student loan interest rate private you a card as much as $1,100000 having closing costs.

And when you use them for a consequent pick or refinance, they’re going to give you good Anticipate right back extra borrowing as much as $2,100 which can be used towards the settlement costs.

New: They’re also providing a 5% money back extra and see cardmembers exactly who place the appraisal put on the cards, now through .

Exactly how Certainly are the Cost?

To phrase it differently, it should be a holder-occupied, unmarried home, as well as the debtor have to have an effective Fico get away from 720 or higher.

At exactly the same time, Look for appears to be adverts cost to possess loan-to-really worth rates of 70%, that’s not the standard 20% off, or 80% LTV.

Therefore you need to has a pretty pristine loan circumstances to help you snag their stated rates, and that search a tad highest, specifically having mortgage things becoming paid.

Currently, they appear provide mortgages during the forty eight says, plus the District off Columbia. New york and you will Utah is absent on checklist.

It is not sure in the event that these types of states was added later because operations presumably build, however if very, it might be detailed right here.

Possibly it’s section of a delicate roll-off to verify everything you turns out since the prepared prior to getting toward all the fifty says. Or it is simply an easy (or cutting-edge) licensing issue.

If you live-in among the many says stated over, and require details away from Discover’s financial credit program, call them right up from the step 1-888-866-1212.

It’ll be fascinating to see how Find navigates the borrowed funds market. They yes enjoys a huge amount of established consumer relationship to faucet into the, therefore they shall be in a position to develop rapidly, and perhaps make the home loan sector even more aggressive.

Regardless of if my personal imagine is that they’ll give some high-than-sector financial costs so you’re able to present credit card consumers, and lender to their faith and precision to get it all the over.

90 thoughts on Look for Home loans Opinion

There will be something completely wrong which have Find Home loans. We had been looking around to help you refinance, as well as the 3 financial institutions I was talking-to, Pick given new bad rate (step 3.75% which have 25 % part, whereas I’d step 3.75% with .46 disregard things away from my most recent financial). Very, a lot of time tale short, we failed to proceed with these people, however, i felt like so it from the area anywhere between providing my personal borrowing credit facts in order to pre-authorize an appraisal and you will before going ahead and finalizing one thing. The new pending fees to own $6.80 try designed to come-off of my bank card if the I didn’t signal new records. But instead it turned a beneficial $eight hundred charges to possess an assessment that’s never ever going on. Luckily for us Pursue Visa’s conflict procedure have a tendency to cover me out of needing to spend. But I can not rating Look for to help you contrary the new charge, if you don’t admit one to I’m not refinancing together. I just found several other fees to own $20 to my home loan statement to possess a rewards statement that they expected! As to why in the morning We paying in their eyes becoming dumb and violating RESPA?