Not only really does SoFi provide a simple-to-use app, however it is and famous for the zero-percentage mortgage products and user-centric business structure. Comprehend the when you look at the-depth SoFi unsecured loan opinion to determine if it is best lender to you personally.

SoFi also provides rock-bottom rates and higher mortgage limitations than simply extremely loan providers. Their finance are designed for well-qualified people. SoFi cannot fees a keen origination fee, later fees, otherwise a prepayment punishment.

- Aggressive rates of interest

- Zero fees

- Paused repayments for unemployment

- Large minimum amount borrowed

Full SoFi Signature loans feedback

- Competitive interest levels

- No fees

- Paused costs to own unemployment

- Highest minimum loan amount

Best benefits

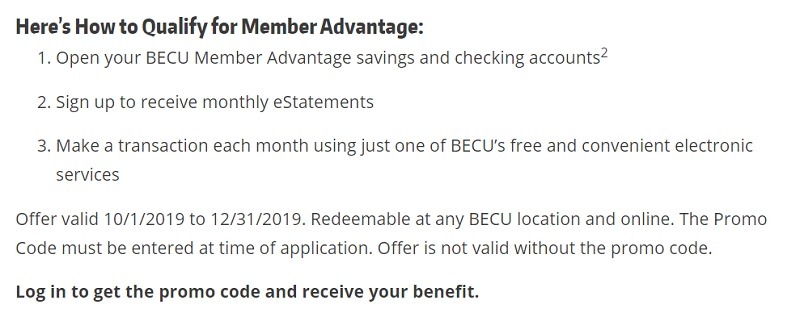

Lowest loan interest have a glimpse at the website rates: SoFi’s lowest pricing are a standout that go toe in order to bottom with some quite competitive lenders in the business. SoFi (small to possess Societal Loans) has actually pricing lowest using its rigorous lending requirements, for example a good credit score and you will an appropriate balance cash and you can expense. The low costs make a beneficial SoFi financing a beneficial choice for someone researching to combine and you can pay off high interest credit card debt.

Zero charges: SoFi — such as for example a few of all of our greatest loan providers — wouldn’t charge a fee charges. That implies there aren’t any origination charge no late charges. If you opt to shell out a SoFi financing of early your won’t have to value an awful prepayment punishment. In the event a competition provides you with a slightly lower personal loan rates, you might save money by the choosing SoFi because of its fee-100 % free rules.

Autopay dismiss: You might secure a good 0.25% rates disregard for individuals who install automated financing money out of your bank account.

Large loan quantity: SoFi’s mortgage numbers range from $5,100 so you’re able to $100,one hundred thousand. It is at the very least double the restrict amount borrowed supplied by most of SoFi’s battle.

Paused money having jobless: SoFi will allow you to stop your monthly obligations for people who get rid of your work. So it jobless defense are capped for the three-times increments having a maximum of 12 months along side existence of one’s loan. If a worldwide pandemic has actually trained you something, it’s you to definitely economic issues is also struck at any time.

View cost rather than affecting your credit score: Like many on line lenders, SoFi are able to use a flaccid credit assessment that does not hurt your credit rating to demonstrate your what prices your prequalify to possess. It is far from until you plan to undertake SoFi’s promote your bank works a difficult credit check to verify your details.

Same-time investment: At SoFi, most frequent consumer loan apps made before 7 p.m. into working days was financed an identical date.

Easy-to-fool around with cellular software: SoFi makes it easy to-do business irrespective of where then when your want through providing a sophisticated, user-friendly mobile app you to definitely enables you to borrow, purchase, and you will rescue. It can be used to test your own speed and implement to possess that loan, along with manage your SoFi Invest membership and you will SoFi examining, offers, and you may loan account.

Entry to representative benefits: SoFi phone calls its customers participants. You get over financing when you use away from SoFi. As an associate you rating totally free usage of unique benefits such as field instruction and you can economic believed, including coupons out of property considered properties. SoFi in addition to preparations associate feel and you may accessibility the latest Affiliate Sofa within SoFi Arena.

Exactly what might be increased

A great deal more varied mortgage quantity: SoFi will be a far more versatile loan provider when it offered money in order to consumers shopping for below $5,100000. If you would like a loan to correct busted pipelines or replace a few window, you’re probably maybe not shopping for a great $5,100 financing.